Seychelles has become one of the leaders in the offshore industry. The authorities have adopted several norms and standards in order to have a good international reputation in the field of finance, created a tax-free system, accelerated the registration process, and ensured non-publicity of the participants’ data. Investors have become more likely to explore incorporation in this zone to protect assets and intellectual property rights, improve tax policy, transfer management of significant capital, ensure anonymity of owners, conduct international trade, and ship shipping.

Local legislation allows the formation of the following types of business structures:

- International Business Company (IBC).

- Limited Partnership (LP).

- Limited Liability Company (LLC).

- Company with a special license (CSL).

IBC

An International Business Company (IBC) is needed to realize business activities of the island. The IBC type of company is beneficial for companies operating online like IT, for international trade as Seychelles is at the crossroads of the sea routes of Africa and Asia, and for businesses with plans to invest and manage capital without disclosing owners.

The features and details of carrying out this type of business practice are described in the International Business Companies Act 2016.

Benefits of establishing an IBC:

- Anonymity and protection of owners’ data.

- Zero taxes.

- No paid-up minimum capital requirements (the amount is determined by the owners of the company).

- Management requires one manager and owner (one person can fulfill both of these functions) while being either an individual or a corporation. There is no need to find a local general manager; management functions can be performed by either a resident or non-resident.

- Meetings of directors and shareholders are held anywhere the company decides.

- Only registered shares may be issued.

- Hiring a secretary is not mandatory.

The following restrictions must be met when choosing the name of the IBC:

- Only the Registrar may authorize the use of the word “Seychelles” in the name.

- The words “Assurance,” “Bank,” “Trust”, etc. shall be mentioned if licensed for a particular type of business.

- The name can be in any language, most often, they prefer to register in English.

- Uniqueness must be preserved.

- The name is mentioned in the Memorandum and Articles of Association.

Only the Articles of Association and the Memorandum of Association are publicly available, all other documents remain with the registration agent, with all information kept confidential.

LP

A limited partnership is formed under the rules of the Limited Partnership Act 2003 (amended 2011), allowing two or more persons to conduct business.

The features of an LP include:

- Partners can be resident or non-resident.

- Business activities take place outside the islands

- Local registered office.

LLC

A Limited Liability Company (LLC) in Seychelles has several advantages such as:

- No tax on profits earned outside the islands, no tax on real estate transactions, or income from exports or imports.

- Owners are liable in proportion to the funds contributed, the obligations of the corporation do not apply to them.

- There is no minimum capital amount (at the discretion of the company).

- Owners’ directors can be both local residents and foreigners.

However, when conducting LLC activities on the islands, companies are taxed.

CSL

An international company with a special license (CSL) is registered under the Companies (Special Licenses) Act 2003. This business structure is similar to IBC; the difference is that it is necessary to obtain a license from the International Business Administration (SIBA).

Criteria for establishing a CSL:

- Permitted to conduct business activities within and outside the country.

- There must be two shareholders and two principals of the company.

- The initial capital is $1.

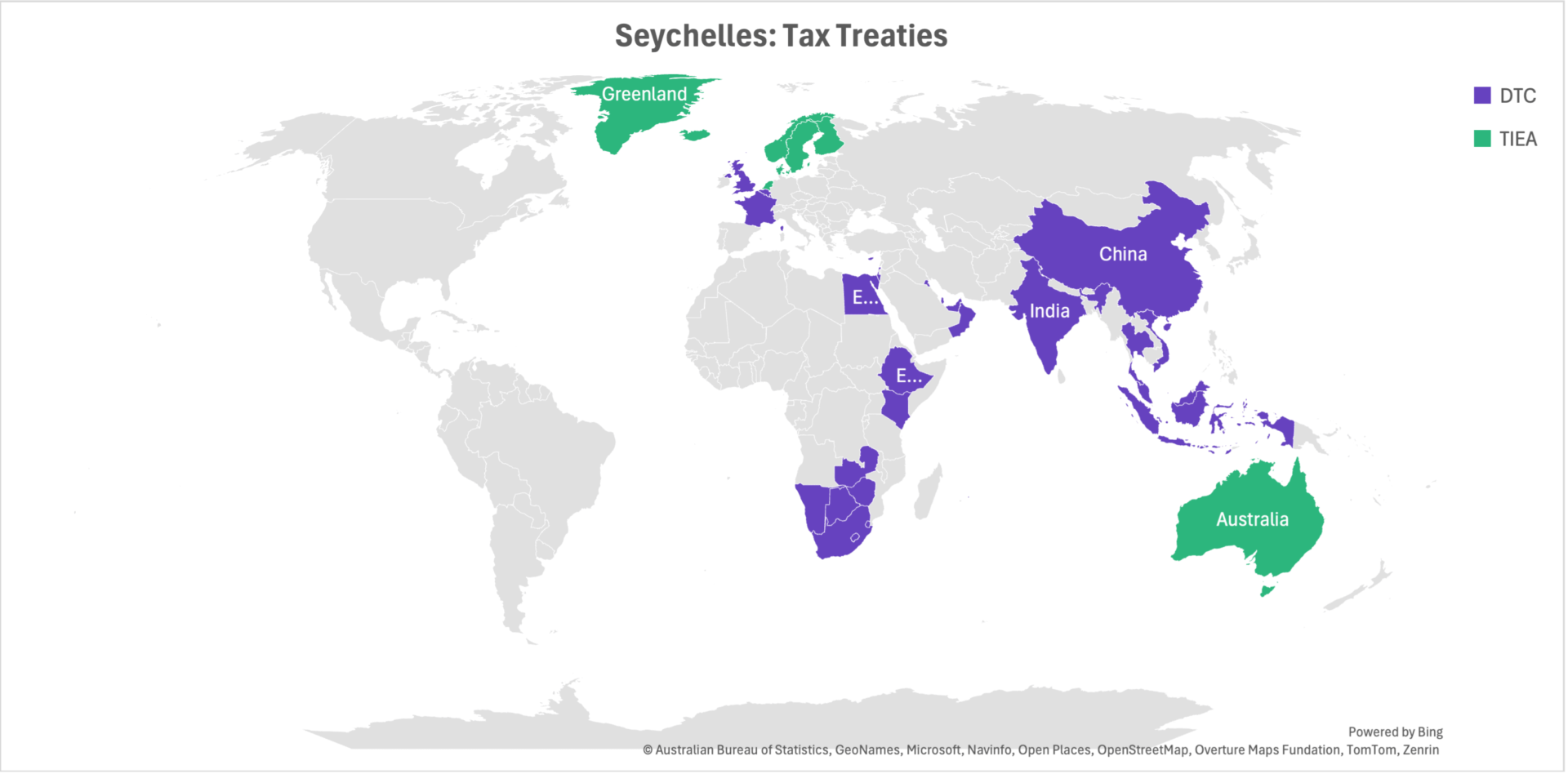

The advantages of a CSL (when operating in Seychelles) include – exemption from certain taxes such as stamp duty, export/import, and 1.5% corporate tax. If the business is connected with China, Belgium, or Thailand, the norms of double taxation treaties signed with Seychelles come into effect.

Trusts

FSA controls the business functioning of trusts, applying to them the Trusts Act 2021, which has been amended since 1994 to incorporate the rules of advanced jurisdictions. This has helped shape some of the best laws in the world, providing robust asset protection and wealth management for 340 established and active local trusts. Another advantage of this zone, among other competing offshore jurisdictions, is the negligible company setup costs.

Options for trusts in Seychelles:

- international;

- charitable;

- earmarked;

- others – trading, life insurance, deposit trusts, etc.

Investors most prefer to register discretionary trusts.

Standards in forming a trust:

- The settlor is a non-resident.

- The management company must have a specific license to provide trust management services.

- No property in the territory of the islands.

- The term of the trust registration is 100 years from the date of creation.

Financial Services

FSA controls the financial market, under its regulation are eight commercial banks (2 local and six international), one credit union, 41,436 IBCs, 340 trust funds, 263 service providers, five insurance companies, and the activities of 1 stock exchange with a portfolio of $856 million. Depending on the type, each company receives the benefits of registering in Seychelles.

E-Commerce

Seychelles is convenient for business registration and online business e-commerce. It allows us to expand to other regions of Africa and Asia to open new promising markets. According to statistics, the revenue in the Seychelles E-Commerce market in 2024 is expected to reach $96.14 million with a total market size of $1,469.00 billion. According to forecasts, the number of users in this area will grow to 33.8 thousand in 2029.