Anguilla is considered a British Overseas Territory of Great Britain, where English law is established, which facilitates the procedures for resolving disputes between shareholders. International anti-money laundering and anti-fraud procedures are strictly adhered to here. The country is a member of the CARICOM trade and economic union.

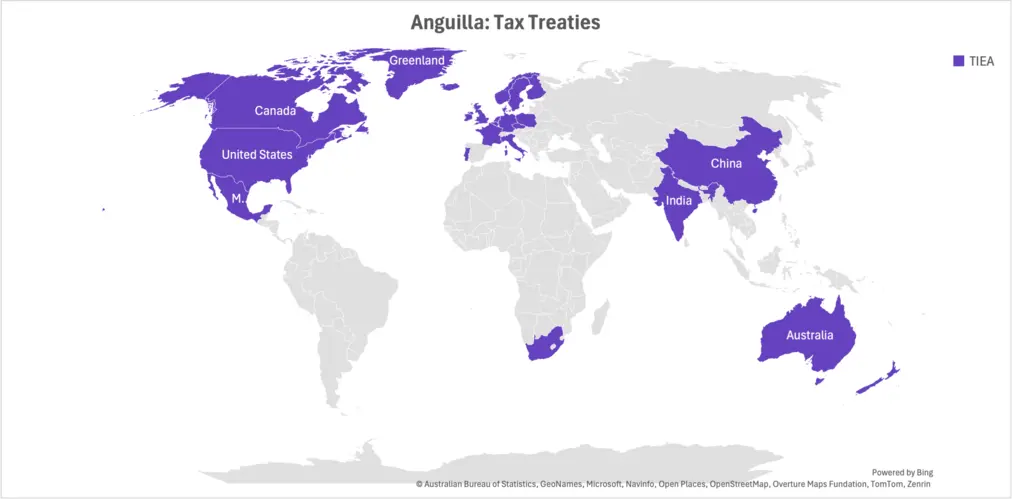

This jurisdiction attracts businesses with its tax-neutral position, absence of restrictions on trade and currency exchange, economic stability, and developed financial system.

Anguilla company registration, of any type (IBC, LLC, LP), can be done quickly from anywhere in the world online thanks to the Commercial Online Registration Network (ACORN).

The Anguilla Business Companies Act, 2022 (ABC Act) is the main law that sets out the mechanisms, and key requirements for the establishment of a company and its operation.