The island state of Saint Lucia became independent in 1979 and acquired the status of a sovereign state of the British Commonwealth. The main income comes from tourism, agriculture (fruit growing), and foreign investments.

Today St. Lucia’s favorable location plays a huge role for the country as it is part of CARICOM, which opens up the Central American market for business. It is also one of the 79 member countries of the OACPS organization, the main idea of which is economic cooperation.

Since 1999, to attract investments from all over the world, St. Lucia started to offer benefits for offshore businesses: no tax on income and capital gains. Also here strictly adhering to the principles of confidentiality of information, international companies do not publicly disclose data on shareholders and managers of the company. The activity and process of incorporation of foreign companies in Saint Lucia is regulated by the Law on International Business Companies (IBC).

More than 30 banks are operating on the territory of the island state, 10 of which are members of the Association of Caribbean Banks, it is possible to work with 15 currencies.

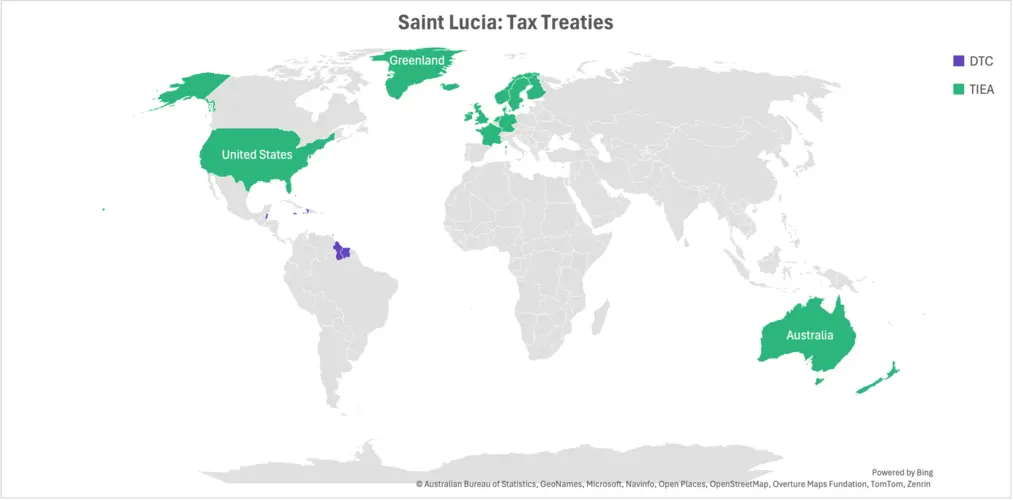

Saint Lucia has signed double taxation treaties with 11 countries (Jamaica, Dominica, Barbados) and 17 countries (Great Britain, France, Denmark) on the exchange of tax information.

Advantages of company registration in St. Lucia

High level of confidentiality.

Only the Articles of Association and Memorandum of Association are publicly available. Data on the director and beneficiary are closed for general notification.

There is no tax on income.

But, if the income was received in the territory, it is necessary to pay 30%.

Developed economy.

There are many banks, whose reputation is confirmed in the international market. Opening an account is not a problem as the official language is English.

There are no requirements for the amount of initial or advanced capital.

There are no restrictions on the residency of founders and managers. Company registration in Saint Lucia costs are minimal.

No audit.

IBCs are only required to file annual unaudited financial statements. No AML / KYC managers.

Quick registration, minimal requirements.

Mandatory requirements include one director and one founder.

Wide range of activities.

IBC can engage in any legal form of international business.

Annual meeting of shareholders.

Can be held in different countries.

Access to international markets.

Many international treaties open cooperation with the countries of the Pacific region, and develop banking systems.

Requirements for starting a business in St. Lucia

Directors and founders.

The mandatory requirements include having one director and one shareholder, a secretary (there are no residency requirements, can be a legal entity or a private person), as well as having a registration agent.

Legal address.

The company must have a registered office, but a physical office is not required.

Company name.

Must be unique, not repetitive with local businesses, and contain Inc., Corp., Ltd., GmbH, or SA.

Initial Capital.

There are no minimum capital requirements, but the average for an IBC is $50,000.

Company documentation package.

Company formation in Saint Lucia requirements include an order appointing a director, proof of office registration, a memorandum of association, a statement from the owner that he is of legal age, and identification documents for the director and shareholders.

An IBC cannot own real estate in Saint Lucia.

The only exception is the company’s office.

License.

A license is required for banking, insurance, and trust practice.

Company registration process in Saint Lucia

The process of Company registration in Saint Lucia and the operation of international business is based on the regulations of the International Business Companies Act (IBC). For offshore corporations, there is the possibility of remote registration.

Selection of name options

Name Requirement:

- Unique, not similar to the name of local businesses

- Check-in a special registry – Business Name search.

- The name must contain Inc., Corp., Ltd., GmbH, or SA.

Company Registration

Requirements:

- Company documents: company statutes, contracts, order of appointment of director, identification documents of manager and founder, proof of legal address.

- Payment of state duty – EC$850.

Documents are considered for 2 days, registration certificate is issued for 6 days.

Registration in the tax office

The company needs to obtain a taxpayer identification number TIN from the

Department of Internal Revenue.

Registration in the social service

It is also necessary to register with the National Insurance Corporation for the company to be registered as an employer in the social security system.

Compliance

IBCs must file an Unaudited Financial Statement (UFS) with the St. Lucia Internal Revenue Department (IRD).

Pay a government fee of $300 each year.

Taxation in St. Lucia

For international corporations, the government of St. Lucia has imposed the following taxes:

- Corporate Tax – 0% if income is earned outside the country and 30% if in the jurisdiction.

Income earned outside of Saint Lucia is:

- income from a company registered in another jurisdiction

- income from immovable property located in another country

- income from investments in securities (issuer is not a resident of St. Lucia) royalties from an international enterprise

- income from sources outside the country to avoid double taxation.

- 12.5% VAT on profits earned within the country

- 1% on profits

- 0.4% commercial real estate

- 5% social insurance

- license fee

- $300 each year state fee

Country Information: Saint Lucia

| Square | 617 sq km |

| Population | 183,627 |

| Capital | Castries |

| Unemployment Rate | 16.8% |

| State Polity | Parliamentary democracy under constitutional monarchy |

| Telephone Code | +1 758 |

| Corruption Rank | 45 |

| Location | Caribbean |

| Climate | Tropical, moderated by northeast trade winds; dry season from December to May, rainy season from June to November; avg. max temperature 30°C (86°F), avg. min temperature 24°C (75°F) |

| Literacy Rate | 90.10% |

| Ethnic Groups | Black 85.3%, Mixed 10.9%, Indian 2.2%, White 0.6%, Other 1% |

| National Currency | Eastern Caribbean Dollar (XCD) |

| USD Exchange Rate | 1 USD = 2.70 XCD |

| GDP per Capita | 10,869 USD |

| Official Language | English |

| Credit Rating | BB+ |

| Judiciary | Magistrate’s Court, Eastern Caribbean Supreme Court (High Court and Court of Appeal) |

| Executive Authority | Head of government: Prime Minister; Head of state: Monarch represented by the Governor-General |

| Legislative Authorities | Bicameral Parliament consisting of Senate and House of Assembly |

Corporate Information

| Purchase Ready-Made Companies Available | Yes |

| Legal System | Based on English Common Law |

| Use of Cyrillic Alphabet in Company Name | No |

| Local Registered Office Required | Yes |

| Organizational and Legal Forms | International Business Company (IBC), Limited Liability Company (LLC), Corporation |

| BPA in Company Name | Corporation (Corp.), Limited (Ltd.), Incorporated (Inc.) |

| Local Registered Agent Required | Yes |

Shares and Share Capital

| Standard Currency for Shares | XCD/USD |

| Beneficiary Information Disclosed | No |

| Minimum Issued Capital | No restrictions |

| Bearer Shares Allowed | No |

| Authorized Capital Size | USD 50,000 |

| Terms of Capital Payment | No restrictions |

| Nominal Value of Shares | USD 100 |

| Possibility to Issue Shares without Par Value | Yes |

Taxation

| VAT | Yes (12.5%) |

| Basic Corporate Tax Rate | 25% |

| Capital Gains Tax | No |

| Currency Control | No |

| Corporate Tax Rate Details | Standard corporate tax rate is 25%. Special rates may apply to certain sectors. |

| Stamp Duty | No |

Director and Secretary

| Minimum Number of Directors | 1 |

| Residency Requirement for Directors | No |

| Director Legal Entities Allowed | Yes |

| Information Disclosed to Local Agent | Yes |

| Information Disclosed in Public Registry | No |

| Secretary Required | Yes |

| Residency Requirement for Secretary | No |

| Qualification Requirement for Secretary | No |

| Legal Entity as Secretary | Yes |

Shareholder and Beneficiary

| Minimum Number of Shareholders | 1 |

| Data Entered in Public Registry | No |

| Residency Requirement for Shareholders | No |

| Beneficiary Information Disclosed | No |

| Beneficiary Info Disclosed to Local Agent | No |

| Legal Entities as Shareholders Allowed | Yes |

Reporting

| Filing of Reports Required | No |

| Open Access to Reports | No |

| Statutory Audit Requirement | No |

| Filing of Annual Return Required | Yes |

| Open Access to Annual Return | No |

| Reporting Requirements | No |

Trademark Registration

| TM Comprehensive Study Fee | USD 100 |

| TM Registration Request Fee | USD 400 |

| TM Registration Certificate Fee | USD 500 |

| Additional Class Registration Fee | USD 1080 |

FAQ about a Company formation in Saint Lucia

How do I register a company in St. Lucia?

You need to collect the documents, pay the state fees, and submit the application to the Registrar.

How much does it cost to register a company in St. Lucia?

The state fee is EC$850 but may vary depending on what type of company is registered and whether a license is required.

How long does it take to register a company in St. Lucia?

It can take about two weeks to register a company, subject to all requirements being met.

What does the IBC company name mean in St. Lucia?

The term IBC stands for International Business Company. An IBC is registered to conduct international business.

What is the tax rate in St. Lucia for an IBC?

Legal entities do not pay capital gains tax, dividends, and VAT if their source is outside the country.

Can a foreigner set up a business in St. Lucia?

Yes. The Saint Lucian authorities have created a favorable environment for foreign entrepreneurs and investors and do not restrict them in any way from owning a business.