Most investors choose IBC (International Business Company) to conduct offshore business. The main regulations governing the process of establishing corporations are the The main regulations governing the process of establishing corporations are the Associations Law of 1990, Business Corporations 1990, and the Limited Liability Companies Act of 1996. IBCs are usually registered for such activities as marketing services, e-commerce, IT business, consulting, and trade. However, banking, insurance, and trusts cannot be carried out in the territory.

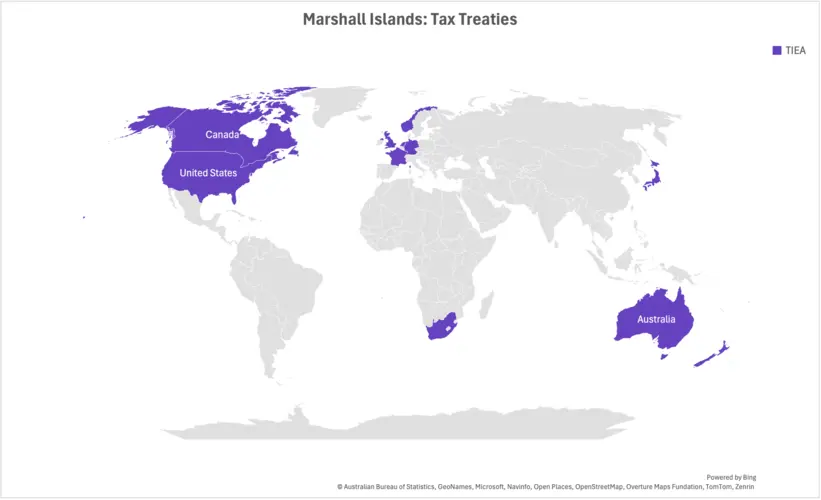

The Marshall Islands are preferred mainly because of the quick registration process, zero taxes, no requirements for financial reporting and annual audit, and confidentiality of information about the ultimate beneficiary. The register includes only data on the registration agent, information about the organization is disclosed only upon official requests from government agencies.

In addition, IBCs are registered in the Marshall Islands for IPO. More than 40 enterprises in this jurisdiction have already placed their shares on the world’s leading stock exchanges.