Jersey is not a part of the UK and EU, it has a certain autonomy – its parliament, legislation, and tax service, but fulfills the decisions made by the English Parliament.

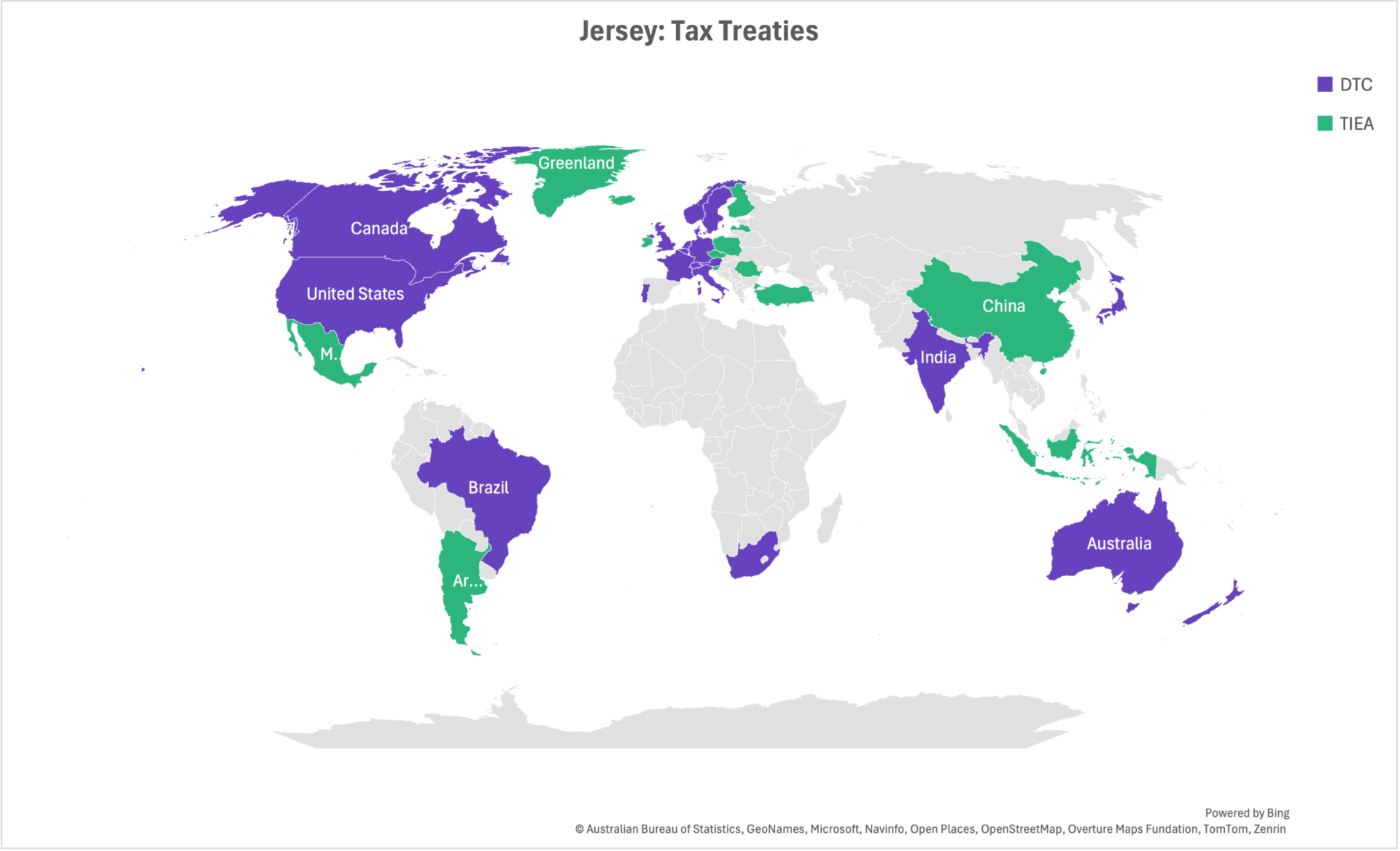

Company Formation in Jersey benefits many entrepreneurs because of the tax-neutral system. A registered business in this jurisdiction receives many preferences: reduction of the tax burden, the opportunity to develop trade relations with Europe, legalization of business in an economic zone with a reliable reputation, and the possibility of IPO. Also, the island’s government has already signed 15 double taxation treaties.

When incorporating a company it is important to comply with the legal rules laid down in Companies (Jersey) Law 1991. Most often IBC (International Business Company) type companies are registered on the island. Some of the main areas are trade, investment financial services, and IT services. The main requirements of their activities include compliance with AML/KYC procedures, financial reporting, and keeping documentation in the local office, it is prohibited to do business with residents, for some types of business is a prerequisite for obtaining a license.