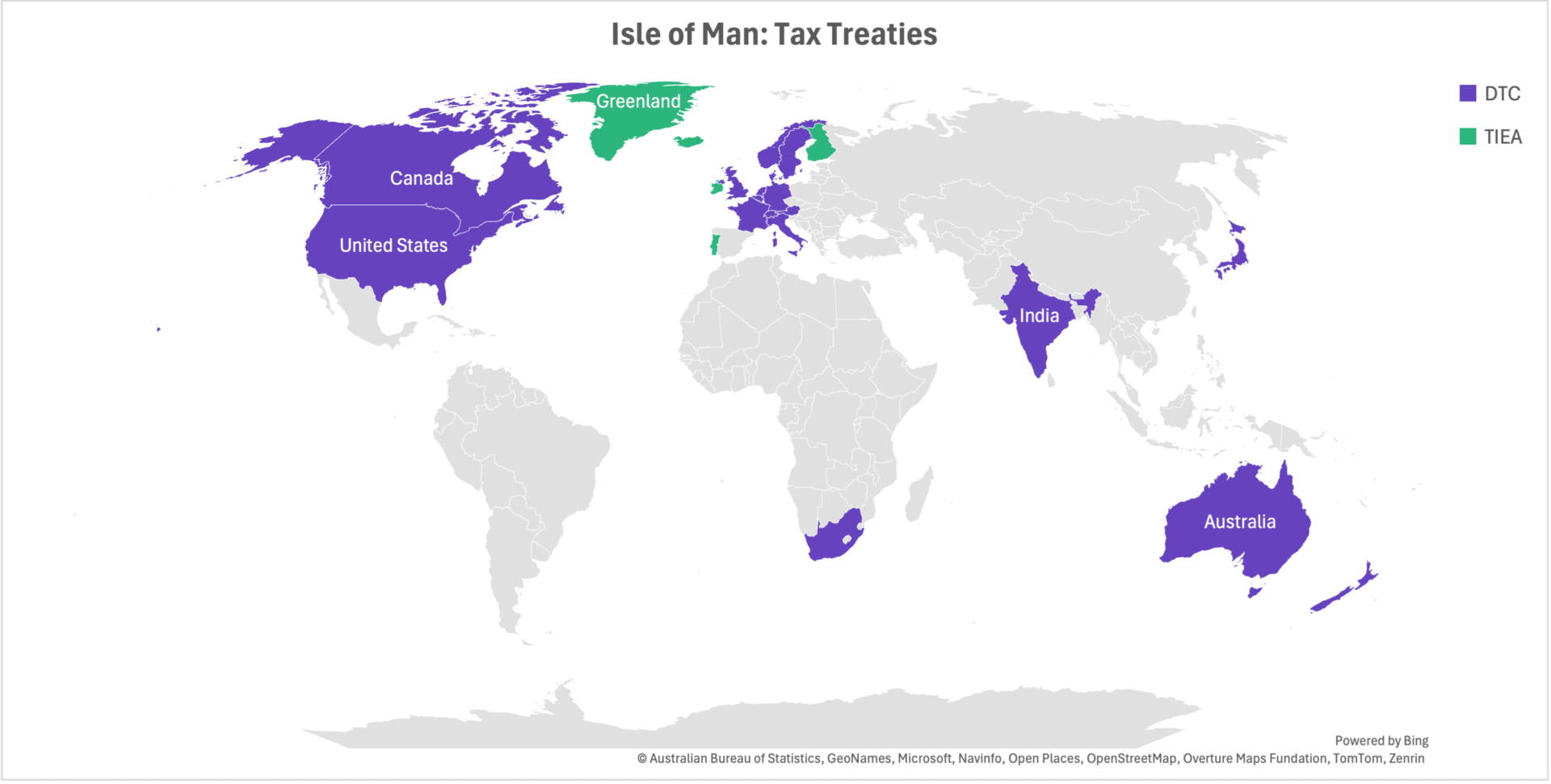

The Isle of Man has certain legal peculiarities – it is not part of the UK or the EU, it has its own legislative and tax system, one of the oldest parliaments in the world, and the UK is in charge of foreign policy and defense.

Isle of Man Company Registration provides many advantages for doing business, as the island has signed customs treaties with the UK and the export of goods to the EU passes through the internal rules of this zone (without customs duties).

Most often choose this jurisdiction for opening a trading company and expanding activities. In addition, this island is interesting for those engaged in gambling activities, but before that, it is worth obtaining a license from the Gambling Supervisory Commission GSC. Financial and insurance companies must have a license from the Isle of Man Financial Services Authority FSA.

The main regulatory documents that specify company formation requirements are The Companies Act 1931 and the Companies Act 2006. The jurisdiction values its reputation and therefore has strict FATF regulations, complies with EU directives (AML/KYC) about illegal enrichment, and has adopted the Income Tax (Substance Requirements) Order 2018 to combat non-payment of tax by companies.