The island state of Barbados with a small area (only 430 square meters) in the Atlantic Ocean, was for many years under British rule, but since 2021 has become a parliamentary republic. Accordingly, the official language is English, and the currency is the Eastern Caribbean dollar pegged to the U.S. dollar.

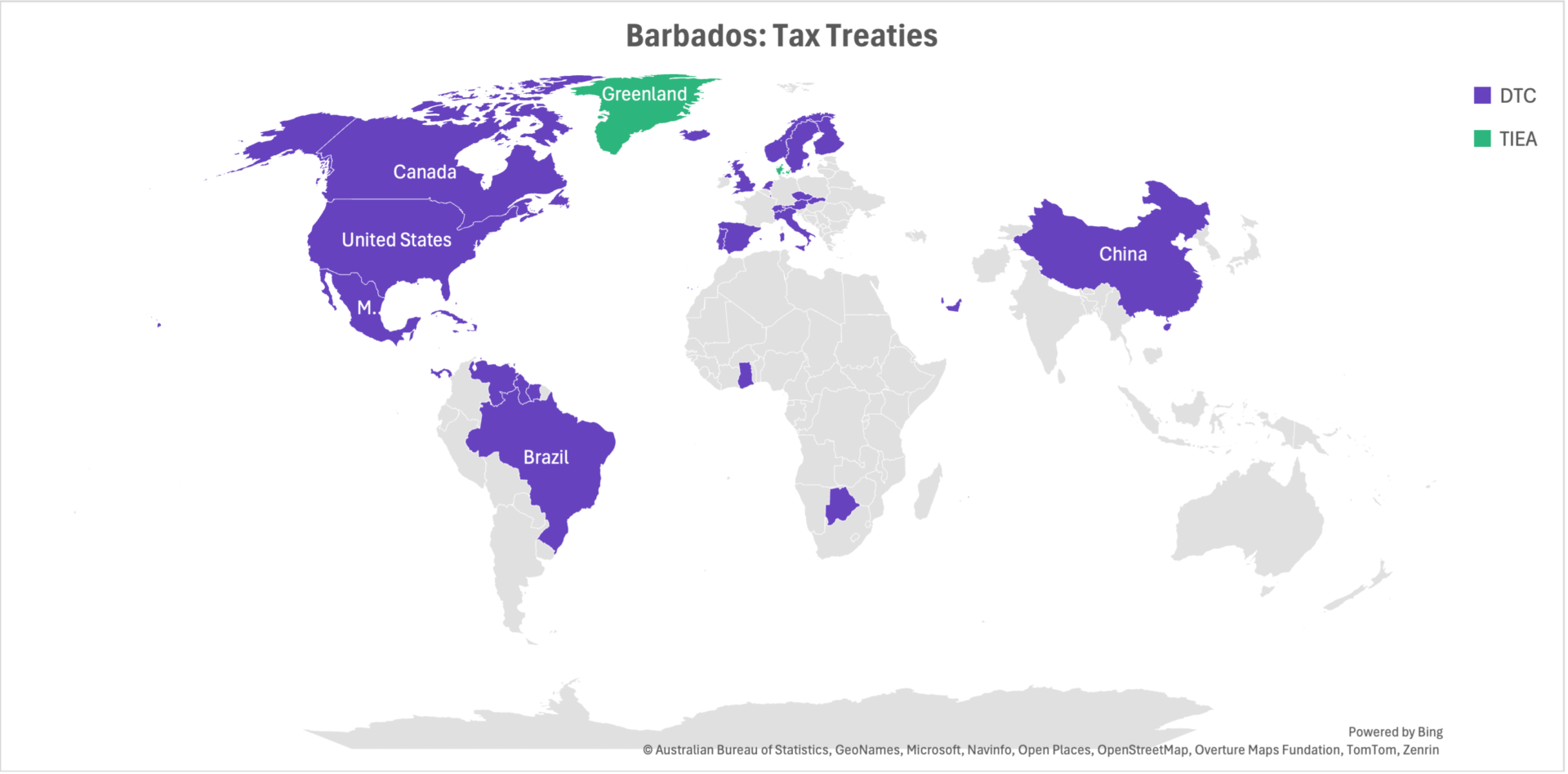

Now the state is one of the leaders in living standards among developing countries. The main income comes from sugar cultivation, tourism, and offshore business. There is no pressure from the state on foreign business, as it brings a significant part of profit to the treasury. For many years the government has built up an attractive system of benefits and incentives to attract investment. The authorities offer favorable tax rates, freedom in currency payments (there is no currency control), data confidentiality, and an expanded system of banks (about 40 recognized by the OECD) to register companies in Barbados and conduct international business. Also signed tax agreements with more than 40 countries: the USA and Canada (the main partners), China, Germany, Belgium, and Switzerland. Barbados remains a member of the Commonwealth of Nations, which gives its privileges.