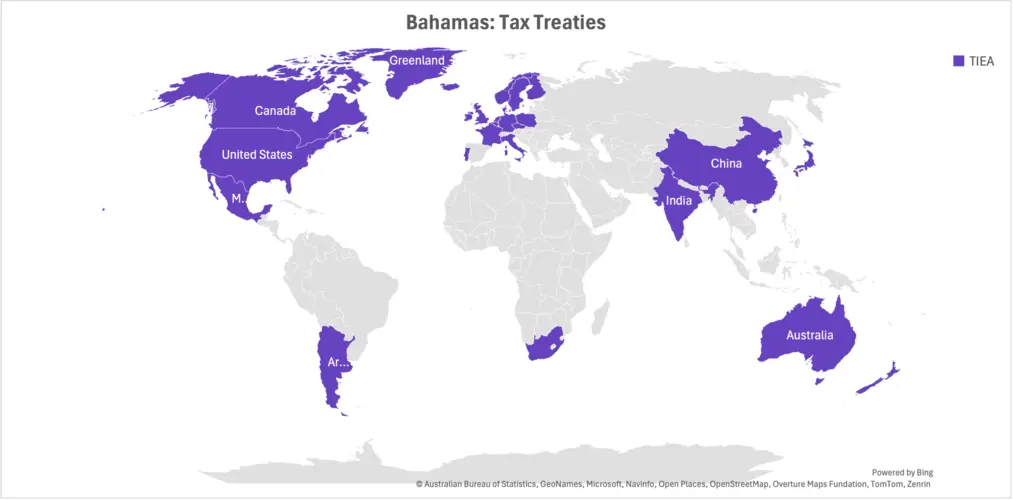

The Commonwealth of the Bahamas is the richest state in the Caribbean region, and its location has also contributed to this. The Bahamas signed tax information exchange agreements with 34 countries, including the United States in 2002.

The tax system is designed with foreign investors in mind and offers several advantages: there are no exchange controls, zero income and capital gains taxes, and zero inheritance taxes. The Bahamas Investment Authority (BIA) encourages investment and helps companies obtain permits based on the Commercial Enterprise Act (CEA), and the International Business Companies Act of 2000.

More than a third of the world’s financial institutions operate in this jurisdiction, with one in five global corporations opening accounts here. Since 2022, the Bahamas has also begun to position itself as a hub for the development of financial technology, introducing the use of digital currency under the Digital Assets and Registered Exchanges Act (DARE).

Many years of the stable political system and, a favorable tax environment provide businesses with favorable conditions for registering a company in the Bahamas.

General Information

| Country Name | The Bahamas |

| Capital City | Nassau |

| Official Language | English |

| Currency | Bahamian Dollar (BSD) |

| Time Zone | Eastern Standard Time (UTC-5) |

| Business Entities | Companies Limited by Shares, Limited Partnerships, and Limited Liability Companies (LLCs) |

| Regulatory Authority | Registrar General’s Department |

| Foreign Ownership | 100% foreign ownership is allowed. |